THE CHALLENGE

Helping a global financial services platform decode the financial behaviour of high-income consumers in Australia

Helping a global financial services platform decode the financial behaviour of high-income consumers in Australia

Insights on consumers’ financial behaviour leading to specific jobs-to-be-done for creating solutions that add value to the financial lives of Australia’s high-income segment

Our client, a global financial services platform, approached Heist with the mission to gain a deep understanding of the mindset and behaviour of high-income individuals in Australia. Insights from this research would help our client’s partners in the Financial Services sector enhance their value propositions and deliver better user experience through differentiated product features that add value to the financial lives of high-income Australians.

To achieve this, Heist looked into key areas of a person’s financial journey, from everyday payments to using debt and growing wealth. We would find specific jobs-to-be-done for each part of this journey that could inform and inspire our client on the core functional and emotional needs of this target segment.

Based on our client’s requirement, Heist set up pop-up studio in Sydney through July 2019. Over the course of 2 weeks, we worked closely with our clients to run fieldwork in Sydney as well as Wollongong. At the end of the research phase, we ran dedicated synthesis sessions in collaboration with our client to review emerging insights and develop a custom Jobs-To-Be-Done framework.

Heist ran a total of 17 interviews – 12 in-depth interviews and home immersions in Sydney and 5 in Wollongong. Each interview was structured to capture not only the financial behaviour of our target segment but also to help us gain a deep understanding of people’s values, ambitions, goals and beliefs that shaped their lifestyle choices and decision-making.

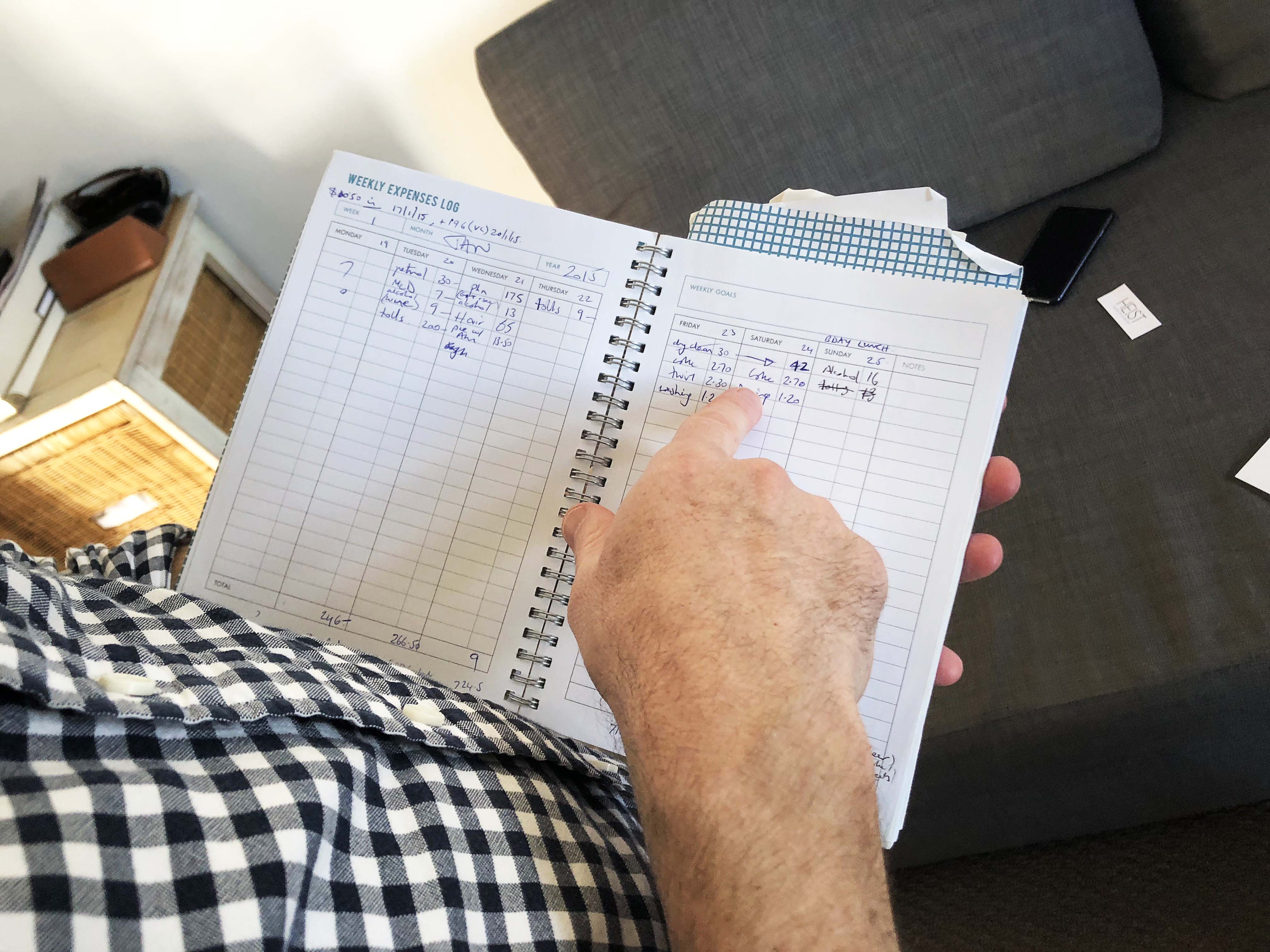

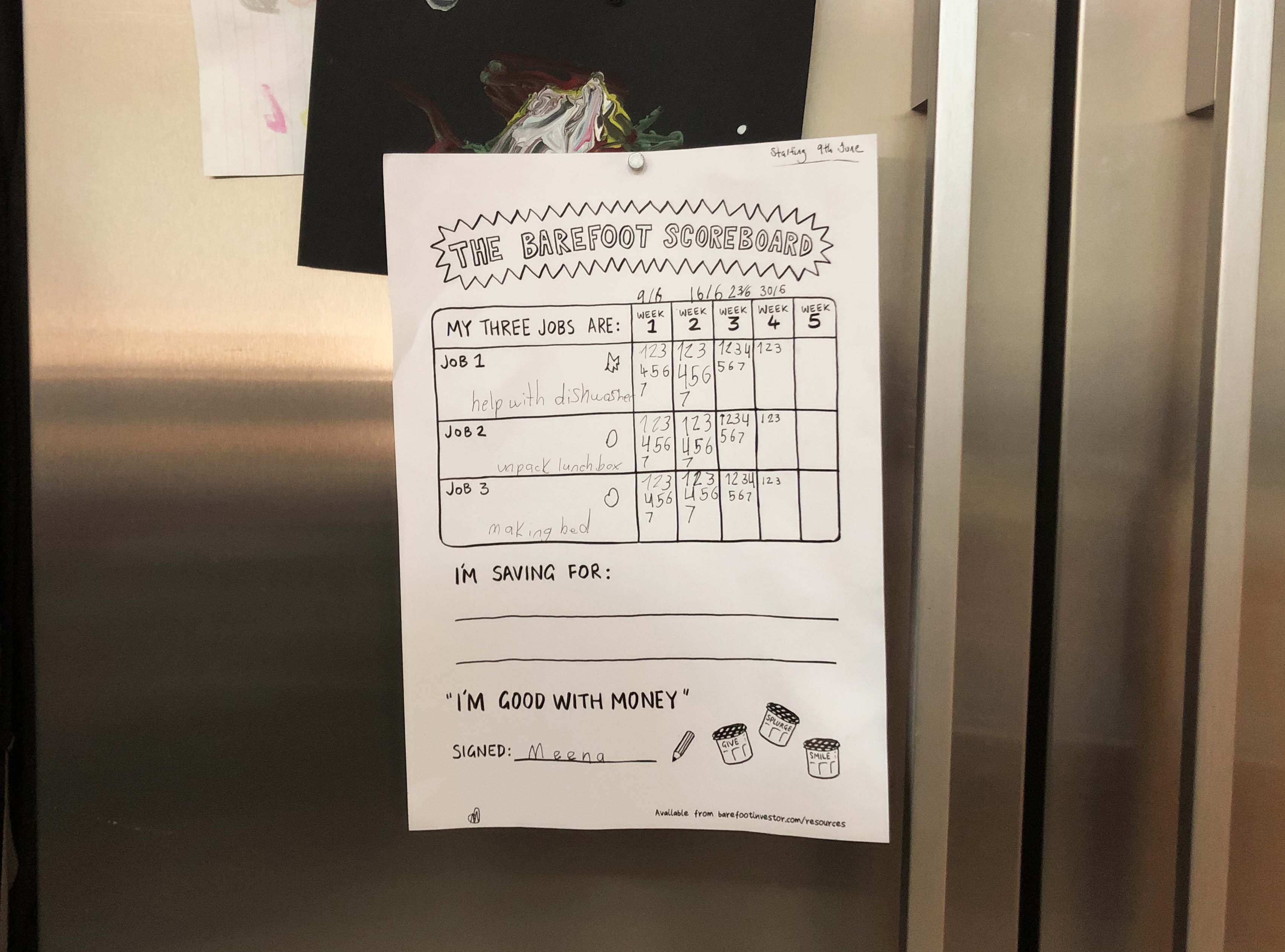

We recognised that conversations involving money could be sensitive. This was mitigated by design probes that took respondents through an interactive journey during the interviews. Our interviews were conducted in an easy-going conversational manner, enabling respondents to feel at ease and in control when articulating their thoughts and sharing the details of their financial habits.

To help our client capture and present the stories of the people whom we spoke to, each session was video recorded. Selected clips were edited into short stories that captured the core jobs-to-be-done for this segment of consumers. We also gained the respondents’ permission to photograph important artefacts in their homes to help us paint a complete picture of their personalities, lifestyles and specific circumstances.

Heist ran a 3-day synthesis at the end of fieldwork where we shared consumer insights with our client. Together, we identified consumer mindsets, distilled customer journeys, developed design principles and crafted specific jobs to be done that would spark new product development opportunities when our client engaged with their business partners in the financial services sector.

Curious where Heist can take you? Call us today.